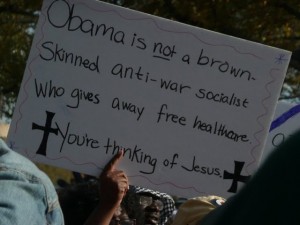

To hear the conservatives tell it, our economy will nosedive if the rich are required to pay an iota in taxes more than they do now. Indeed, we are led to understand the rich already pay more than their fair share, that their taxes need to be lowered so the middle class and the poor can shoulder more of the burden.

It’s understandable why folks under 30 might believe this argument. If the tax rate on the rich, defined by the Obama administration as those earning more than $250,000, is rolled back to nearly 40%, the rich just might not have the money to invest in businesses and create the jobs our country so badly needs. Never mind the fact that the rich aren’t investing in businesses and creating jobs anyway, even though the tax rate for high rollers is historically low.

All we have to do is look at the history of our tax code to see that the opposite is true. Higher taxes on the rich will do more to create businesses and jobs than giving the wealthy a free ride.

When Eisenhower took office in 1953, the tax bracket for those earning $400,000 or more was 92%, and the rate for that select group of taxpayers remained above 90% until 1964, when it was lowered to 77%. If a 40% tax bracket is going to suck all new investments out of the economy, as we are told, how did we ever survive a 90% bracket on the rich? And how can it be that the 1950s saw the largest expansion of our economy in history when the economic movers and shakers were so shackled by high taxes?

Surprise! Surprise! We weren’t as dumb in the ancient 50s as Happy Days would have you believe.

The purpose of the 90% tax bracket was never to rob the super wealthy blind, but to help the likes of Joe Kennedy figure out how best to spend their windfall. Built-in to the tax codes were incentives to help the wealthy taxpayer spend money in civic minded ways that benefited all U.S. citizens. Invest in a factory that will employ the working class, we’ll drop your tax rate. Create an endowment that will help the poor get a college education, we’ll drop your tax rate.

This worked remarkably well. Not only did the rich invest in the U.S. economy and engage in philanthropy, they ended up being proud of their contributions. During the 50s and 60s it wasn’t very common to hear the wealthy complain about high taxes. Just the opposite, in fact. I remember often hearing rich WASP types proclaim how proud they were to pay their taxes and otherwise use their wealth for the betterment of the country (not to say that rich folks back then were angels – they were not).

Obama’s $250,000 ceiling is much too low for such a program to work. I’d say, set a tax rate of 70% for everyone who earns over $1 million, and let them get the rate down to 40% through carefully thought-out incentives meant to put our country back to work.

It’s time for the wealthy to again pay for their privilege.

- CES Rolls the Dice and Gambles on Becoming a Superspreader Event - December 31, 2021

- Boston ‘Free Assange’ Rally To Be Held Friday December 31 - December 26, 2021

- Italian Courts Find Open Source Software Terms Enforceable - December 24, 2021

hey cris i would be very glad to be in a high tax bracket, if their sick of taxes lets trade! and here is some wonderful news for the tax weary i pay NO taxes on a princely income of 13 thousand dollars.so please apply below to find out more about your new life also you will be eligible for free food (stamps). and you may be eligible for some luxurious public housing.don’t delay, no taxes,free food,public housing but wait there’s more you may be eligible for medicaid.this is your lucky day please hurry so i can take up your miserable over taxed life. gator jones

It does seem that many of our wealthy citizens have lost sight of the fact that privilege comes with responsibility. Now, when we point that out, we’re accused of trying to start a “class war.”

Well, Christine, they only call it “class warfare” when we attempt to fire back. As long as they’re winning without having to defend themselves, it’s just “business as usual.”

Actually Gator, you pay sales taxes everytime you buy something and I’m sure you contribute to property taxes everytime you pay rent. I once read an article when i was a kid about Col. Tom Parker, Elvis Presley’s manager, who stated he thought it was his patriotic duty to keep Elvis in the 90% federal income tax bracket. I always thought that was funny.